|

|

PB Law Blog... Trusts and Stuff

Monday, May 20, 2019

In March of 2017, a good friend of mine died tragically in a horrific car accident. She left behind her 9-year old twin daughters. The event prompted me to ask- what happens in the Worst Case Scenario... Read more . . .

Friday, May 17, 2019

Here’s what you can do to make your business and asset protection as strong as possible...Read more . . .

Tuesday, May 7, 2019

Great article that covers common estate planning myths (that we hear about all the time)...Read more . . .

Tuesday, April 30, 2019

Mortality is a bizarre concept to wrap your mind around...Read more . . .

Friday, April 19, 2019

To me, Wealth is NOT about money... I gauge my wealth on the relationships I have, the quality of time I am able to enjoy with my family, the level of joy and happiness I feel when I am able to provide experiences and special moments with my children. Yes, money does afford me the ability to create certain experiences with my family and friends, but I don't measure my wealth by the size of my bank account...

Read more . . .

Friday, April 5, 2019

Great Forbes article on why Nevada is an excellent choice for estate planning & asset protection.Read more . . .

Monday, April 1, 2019

Spring has sprung! As our lives become busier, we tend to place organization on the lower end of the priority list. Since Spring is the season of fresh starts, this is a great time to revisit the things you have been putting off and incorporate some tools to help you stay organized!Read more . . .

Wednesday, March 20, 2019

Landlords can be held liable for their tenants' discriminatory behavior... scary!Read more . . .

Wednesday, March 13, 2019

The worldwide web has provided us with great opportunity to be more independent as consumers. However, as convenient it may seem, you might want to think twice before creating an estate plan online!Read more . . .

Sunday, March 3, 2019

Ahhh… Tax Season... If you’re like many people, you may have filed an extension for your 2018 federal tax return, so take a look and see if any of these tips might apply to last year. Otherwise, be sure to make the most out of these ideas for your 2019 tax planning!

Read more . . .

Tuesday, January 22, 2019

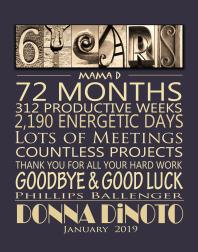

To Our Clients, Partners, & Friends, Happy New Year! We hope that you had a happy holiday and were able to get some well-deserved time off. The new year has brought some big and exciting changes to Phillips Ballenger, and because we value our clients so much, we want to keep you in the know. First and foremost, it saddens me to say that my wonderful assistant of 9 years, Donna DiNoto, will be leaving Phillips Ballenger on January 23, 2019...Read more . . .

|

|

|

|